India’s GST System in 2025: Key Trends, Updates & Future Outlook

The Goods and Services Tax (GST), introduced in July 2017, transformed India’s indirect tax system by replacing multiple state and central taxes with a unified framework. Over the years, GST has improved tax compliance, increased transparency, and simplified interstate trade.

As India moves toward 2025, the GST system is expected to undergo further reforms driven by digitization, automation, MSME support, and global alignment. These changes will significantly impact businesses of all sizes. This article explores the key GST trends, upcoming updates, and future outlook to help businesses stay compliant and competitive.

Structure of GST in India (Quick Overview)

India’s GST system is divided into multiple components to ensure fair tax distribution between the central and state governments:

CGST (Central GST) – Levied by the Central Government

SGST (State GST) – Levied by State Governments

IGST (Integrated GST) – Applied on interstate transactions

UTGST (Union Territory GST) – Applicable in Union Territories

This structure ensures seamless tax credit flow across states while preventing double taxation.

1. Increased Digitization in GST Processes

Technology will play a major role in shaping GST compliance by 2025.

Expansion of E-Invoicing

E-invoicing, currently mandatory for large businesses, is likely to be extended to small and medium enterprises, reducing manual data entry and invoice mismatches.AI-Powered GST Compliance

Artificial Intelligence and Machine Learning will help authorities detect mismatches, fake invoices, and tax evasion more efficiently.Enhanced GST Portal Experience

The GST portal is expected to become faster, more intuitive, and less error-prone, improving return filing and refund processing.

2. Rationalization of GST Rates

Simplifying the GST rate structure remains a priority for policymakers. Changes on the horizon include:

Merger of Tax Slabs

The possible merger of the 12% and 18% slabs could reduce confusion and classification disputes.Regular Rate Reviews

GST rates may be adjusted periodically based on inflation, consumption trends, and sector-specific growth.

3. Inclusion of New Sectors

To broaden the GST base, additional sectors and products may be brought under its ambit:

Petroleum Products & Real Estate

Including these sectors could simplify taxation and reduce cascading taxes.Digital Economy & Gig Platforms

Online services, freelancers, and gig platforms may see tighter GST regulations to ensure fair taxation.

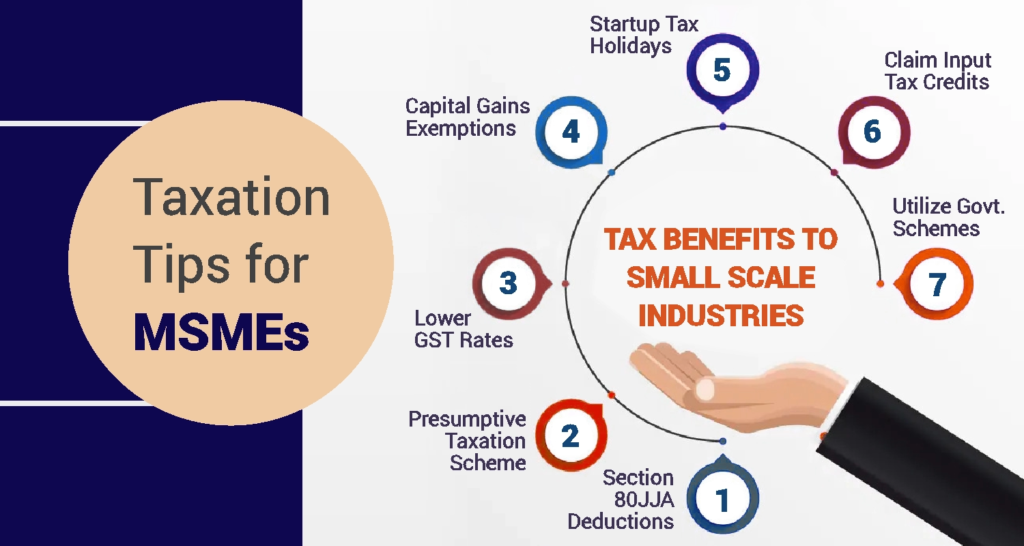

4. Focus on MSMEs

Micro, Small, and Medium Enterprises (MSMEs) will benefit from targeted reforms, including:

Benefits for MSMEs

Simplified Compliance

Reduced return filings, automated reconciliation, and simplified rules for small businesses.Targeted Tax Incentives

Incentives promoting digital adoption, exports, and technology-driven accounting systems

5. Global Alignment & Cross-Border GST Reforms

GST reforms will aim to align with global practices, facilitating international trade:

Faster Export Refunds

Simplified and automated GST refund mechanisms for exporters.Cross-Border Tax Harmonization

Aligning GST rules with international tax standards to support global trade and digital services.

The structure of GST levies different types of taxes in India based on their sources and destinations. Here is an explanation of each type:

| Tax Type | Full Form | Description |

|---|---|---|

| CGST | Central GST | The central government imposes CGST on the movements of goods or services within a state. |

| SGST | State GST | The state government imposes SGST in the state where the transaction, sale, or consumption of goods or services takes place. |

| IGST | Integrated GST | IGST applies to all goods or services moving between two or more states or union territories. |

| UTGST | Union Territory GST | The central government imposes UTGST on goods or services moving within the Union Territories of India. |

Frequently Asked Questions (FAQ)

GST in 2025 is expected to focus on increased digitization, wider e-invoicing adoption, simplified tax slabs, MSME-friendly compliance, and inclusion of new sectors such as petroleum and digital services.

Yes, the government is expected to gradually extend e-invoicing requirements to smaller businesses to improve transparency and reduce tax mismatches.

There are strong discussions around merging the 12% and 18% GST slabs to reduce complexity and classification disputes.

MSMEs will benefit from simpler return filing, automated compliance tools, faster refunds, and targeted tax incentives.

Petroleum products may be included under GST in the future, which could simplify taxation and reduce fuel-related cascading taxes.

Businesses should use GST-ready billing software, adopt e-invoicing early, ensure accurate compliance, and stay updated with GST notifications.