E-Invoice Software for Modern Indian Businesses

Why Choose Sonic Software for E-Invoicing?

Many Indian businesses still rely on manual processes or use multiple tools for billing and compliance. Sonic E-Invoice Software simplifies everything by bringing invoicing, accounting, and GST compliance into one secure platform.

Key Advantages:

• Unified billing and accounting integration

• Direct GST portal connectivity

• Tailored features for Indian SMBs

• Affordable pricing for startups and growing businesses

At Sonic, our focus is simplicity — helping you spend less time on compliance and more time on business growth.

Key Features of Sonic E-Invoice Software

1. Cloud Access

- Access invoices, reports, and customer data anytime, anywhere.

- Automatic cloud backups keep your data safe.

- Ideal for businesses with multiple locations or remote operations.

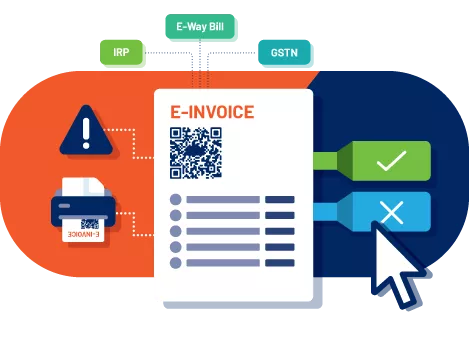

2. Fast E-Invoice Generation

- Create GST-compliant e-invoices instantly.

- IRN and QR code are automatically generated.

- Save time with automated invoice creation from your billing system.

3. GST & Tax Compliance

- Auto-calculate CGST, SGST, and IGST.

- Generate GSTR-1, GSTR-3B, and tax summary reports quickly.

- One-click export for filing or accountant use.

4. Error-Free Validation

- Pre-check invoices to reduce mistakes before submission.

- Centralized dashboard for tracking all e-invoice activities.

- Detailed reporting for audits and compliance.

5. Secure Data & User Control

- Role-based access for admins, accountants, and staff.

- AES-256 encrypted cloud storage ensures data protection.

- Daily backups prevent any loss of critical invoice data

E-Invoicing for Startups and MSMEs

Startups and small businesses in India can easily adopt digital invoicing with Sonic E-Invoice Software. It simplifies GST filings, improves payment cycles, and enhances financial transparency — key advantages for growing ventures seeking digital transformation. With intuitive dashboards and mobile accessibility, even non-technical business owners can manage e-invoices effortlessly.

Benefits of Sonic E-Invoice Software

100% GST Compliance: Ensure your invoices meet all government standards effortlessly.

Time-Saving Automation: Generate, validate, and submit e-invoices quickly with minimal manual effort.

Centralized Reporting & Analytics: Track all invoices, payments, and tax data from a single dashboard.

Seamless Integration: Works smoothly with Sonic Billing & Accounting Software for streamlined operations.

Reduced Errors & Faster Reconciliation: Minimize mistakes and reconcile accounts more efficiently.

Industries Served

Retail & E-Commerce

Manufacturing & Distribution

Wholesale & Trading

Logistics & Transportation

IT & Services

Startups & MSMEs

Pricing & Free Demo

Book a free demo today and discover how Sonic E-Invoice Software makes GST-compliant invoicing fast, accurate, and hassle-free.

Book a Free Demo | Download App

Frequently Asked Questions (FAQ)

An e-invoice is a digitally authenticated invoice generated through the government’s Invoice Registration Portal (IRP). It ensures transparency and accuracy in GST filing.

Yes! The software can seamlessly connect with popular accounting and ERP systems for smooth data synchronization and easy invoice management.

Any GST-registered business exceeding the government-defined turnover threshold must generate e-invoices to comply with GST rules.

Absolutely! The platform is designed to support startups and SMEs, providing a simple, affordable, and automated way to handle digital invoicing.

It automates invoice creation, ensures accurate tax calculations, reduces manual errors, and simplifies reporting for faster and error-free GST filing.

Yes, Sonic offers dedicated support, live chat and setup guidance.