GST Accounting Software in Surat | Simple, Secure & Cloud-Based

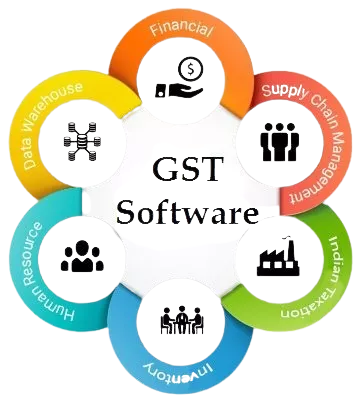

Sonic offers reliable GST accounting software in Surat designed for retail, textile, diamond, wholesale and small businesses. Our cloud-based GST accounting system helps you manage GST billing, accounting entries, inventory, expenses and statutory reports easily from anywhere using web or mobile app.

Difference Between GST Billing Software and GST Accounting Software

GST billing software focuses mainly on invoice generation and tax calculation, while GST accounting software manages complete business accounts including GST returns, expenses, inventory, profit & loss, balance sheet and compliance. SonicBillX provides a complete GST accounting solution for Surat businesses.

Why Surat Businesses Need GST Accounting Software

Surat is a major commercial hub with textile, diamond, and retail businesses. Manual accounting increases the risk of errors, late filings, and compliance issues. Our software enables:

- Quick generation of GST-compliant invoices

- Real-time inventory tracking

- Automated GSTR filing

- Detailed financial reports at your fingertips

- Error-free accounting and audit readiness

Key Features of Our GST Accounting Software

We provide a complete, easy-to-use accounting suite tailored for Surat-based businesses:

1. Automated GST Billing & Invoicing

- Auto-calculate SGST, CGST, and IGST

- Generate invoices instantly for B2B and B2C

- Export reports for GSTR-1, GSTR-3B, and Tally

- Reduce manual errors and save time

2. Smart Inventory Management

- Real-time stock tracking

- Low-stock alerts and reorder notifications

- Barcode scanning and batch management

- Track product expiry and batch details

3. Multi-User & Role-Based Access

- Assign roles to staff and limit access

- Track employee activity

- Secure company data

4. Financial Reports & Analytics

- Profit & Loss statements, Balance Sheet, Cash Flow reports

- GST summary reports for audits

- Visual charts and business insights

5. Cloud & Mobile Access

- Access your accounts from anywhere

- Android & web app with real-time sync

- Perfect for business owners on the move

Who Can Use Our GST Accounting Software?

Ideal for Surat-based businesses:

- Textile traders garment shops

- Diamond wholesalers retailers

- Retail stores and supermarkets

- Clinics, pharmacies & service providers

- Electronics FMCG shops

Whether you’re a small business or growing enterprise, our software scales with you.

Pricing & Free Demo

We offer affordable pricing plans for small and large businesses. Book your free live demo today and experience how Sonic can simplify billing for your Surat business.

Book a Free Demo | Download App

Frequently Asked Questions (FAQ)

GST accounting software in Surat helps businesses manage GST billing, accounting entries, inventory, expenses and statutory reports digitally. Sonic is trusted by local businesses.

While not mandatory, GST accounting software is highly recommended to ensure accurate billing, compliance and timely GST return filing.

Yes, Sonic supports GST reports including GSTR-1, GSTR-3B and other statutory summaries.

Yes, Sonic is designed for small, medium and growing businesses with affordable plans and easy usage.

Absolutely. The software generates GSTR-1, GSTR-3B, and other reports. You can export them for direct filing or share them with your accountant.

Yes, we provide local support in Surat, including on-site installation, training, and remote troubleshooting to help you stay compliant and efficient.

Yes, Sonic offers cloud access and a mobile app to manage accounting and reports anytime.